Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors:

Today’s question is the kind that might make you think, “That’s too complicated,” or “Surely that doesn’t apply to me.”

That’s ok. If you prefer to keep things simple, knowing that you’re leaving tax dollars lying around on the floor, I get it.

However, I assure you that today’s topic is something every well-optimized retirement plan takes into account. If you’re not thinking about it, you might want to reconsider.

Podcast listener Larry wrote in and said:

Jesse, I hear you mention two interesting strategies a lot: the first is low-tax Roth conversions, and the second is paying 0% on capital gains.

Correct me if I’m wrong, but doing one of these strategies reduces your ability to do the other. Right?

So – which one is better? If I have limited space in my financial plan, am I better off paying 0% capital gains or doing low-tax Roth conversions?

This is an awesome question! I’ll provide plenty of background information below, and then explain the right way to think about “income harvesting” in your financial plan.

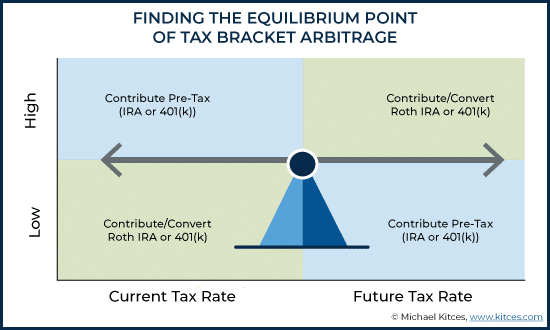

Tax-Rate Arbitrage is the Name of the Game!

The underlying driver behind today’s article is minimizing taxes throughout your life and your retirement.

One of the main tools for doing so is “tax-rate arbitrage.”

Arbitrage usually involves buying an asset in one market where it’s cheaper and simultaneously selling that asset in another market where it’s more expensive – and you profit on that difference.

Tax-rate arbitrage occurs where you intentionally pay low tax rates during one tax year instead of paying a higher tax rate during another tax year, effectively boosting your overall wealth without taking any extra risk.

You Must Know Your Future Tax Rates

Our tax system interplays with the American retirement landscape to create ripe opportunities for tax-rate arbitrage.

One of the underlying necessities is understanding how your tax rate can and will change throughout retirement, as well as recognizing the factors that can cause this change.

It’s about understanding how various factors, including retirement age, Social Security, pensions, RMDs, part-time jobs, the death of a spouse, where you live, and others, can all combine to impact your tax rate from year to year.

A good retirement plan will account for all these factors and create a long-term tax rate projection. You can’t find opportunities for tax-rate arbitrage unless you understand what your future tax rates might look like!

Roth Conversions

Roth conversions are tried-and-true and frequently discussed.

A properly executed Roth conversion allows us to pay low income tax rates today instead of higher income tax rates in the future, when RMDs force us to pay income tax, whether we want to or not.

It’s possible for your pre-RMD years to have a marginal Federal tax rate of 10%, 12%, or 22%, when your post-RMD years will have marginal tax rates of 24%+.

If you can pay 12% tax today on a Roth conversion instead of 32% tax later on an RMD, you must consider doing so.

Tax-Gain Harvesting

“Tax-gain harvesting” describes the process where an investor intentionally realizes capital gains in their portfolio, but does so because they believe they’ll be 0% taxes on those gains.

Even if the investor uses the proceeds from their “harvest” to turn around and re-purchase the same assets, they’ve still accomplished something important: increasing the cost basis of their portfolio.

By realizing capital gains at a 0% tax rate today, they’ve likely prevented a 15% or 20% capital gains tax in the future.

Fighting Over “Space” in Your Tax Brackets

The heart of today’s “problem” is that low-tax Roth conversions and 0% capital gains fight one another over the same valuable resource: “space” in your tax brackets.

Every dollar of Roth conversion (realized income) is one less potential dollar of 0% capital gains.

This is easy to visualize by comparing the income tax rates (below in blue) with the capital gains tax rates (in yellow) as a function of gross income.

By the end of this article, we’ll spell out how to think about prioritizing one over the other as we move up the income axis in this table.

But first – which type of income gets priority filling the “space” in your tax brackets?

For example, imagine a Single tax filer (on the left side of the table above) does $50,000 of Roth conversions and also realizes $50,000 of capital gains – that’s their only income for the year.

How does this $100,000 in total income “stack up” across the tax brackets? The Internal Revenue Code specifies a specific sequencing order for these situations.

- Ordinary income

- Deductions applied against ordinary income

- Capital gains

In our situation, it means that Roth conversions, Social Security, or anything else that generates ordinary income will “crowd out” any “space” for 0% capital gains.

I created this simple illustration using Canva. Let me explain it, from left to right:

- As the Internal Revenue Code dictates, we first examine income. That means our $50,000 in Roth conversions.

- Then, in column 2, we apply deductions against our income. In this case, it’s the $15,000 standard deduction that a Single filer receives. That leaves us $35,000 net income.

- In column 3, I apply the Federal income tax brackets against the $35,000 net. It’s taxed at 10% and 12%.

- In column 4, I take the next step in the IRC: capital gains. My hypothetical scenario called for $50,000 in realized long-term capital gains, which stack on top of the $35,000 in ordinary income.

- Then, in column 5, I apply the long-term capital gains tax brackets (which are illustrated on the right Y-axis: 0% tax applied to capital gains under the $48,350 income threshold, and 15% tax applied to capital gains over the $48,350 income threshold.

In sum, we realize that every additional dollar of income (which we’d pay 12% income tax on) would also push another dollar from our 0% long-term capital gains section into our 15% long-term capital gains section.

Thus, every additional dollar of Roth conversions actually costs us $0.27 in taxes, as if it were getting taxed at 27%.

These types of interactions are essential to understand!

How Do We “Optimize” Capital Gains Over Roth Conversions, or Vice Versa?

Let’s get to the heart of the question: since 0% capital gains taxes and low-tax Roth conversions are competing for the same space in our tax strategy, how do we optimize one over the other?

Are 0% capital gains always worth pursuing over Roth conversions?

Or vice versa? Are Roth conversions always better than seeking 0% capital gains?

The key factor here is tax-rate arbitrage. If our goal is to maximize our long-term after-tax returns, then we must maximize our tax-arbitrage opportunities.

At each income level, we should ask ourselves: “At this stage in our tax strategy, does ordinary income produce better tax arbitrage? Or do capital gains?”

Due to the “ordering” or “stacking” rules in the IRC, you will not be able to toggle back and forth between these different income harvesting methods in the same year. You will not be able to use capital gains at the 10% and 12% income levels, and then revert to Roth conversions in the 22% and 24% income levels.

In the early, low-income stage, harvesting ordinary income (e.g. Roth conversions) is almost always best, as the 0% ordinary income tax rate will save at least 10% in taxes, but as much as 37%, depending on the future tax rate in your tax projection.

Once the 0% income tax bracket is filled, we proceed to the 10% and 12% brackets. At this point, we ideally want to realize 0% long-term capital gains. Doing so realizes a 15% tax arbitrage to the next capital gains tax bracket, whereas paying 12% income tax “only” creates a 10% arbitrage to the next income tax level (22%).

Once we’re in the 22% and 24% income tax brackets, our preference shifts back to ordinary income. At this level, the capital gains rate increases from 15% to 18.8% (15% + 3.8% NII tax). Meanwhile, ordinary income at 22% or 24% presents a 10% or 8% arbitrage opportunity, respectively, against the 32% income tax bracket.

Eventually, though, we’ll hit a point where we’re paying 35% on income and only 18.8% on capital gains. At this point, the arbitrage opportunity flips back to capital gains, as you’d rather save 5% on capital gains (18.8% vs. 23.8%) instead of the 2% opportunity (35% vs. 37%) from income taxes.

A chart helps immensely:

Again, it’s worth pointing out: due to the “ordering” or “stacking” rules in the IRC, you will not be able to toggle back and forth between these different income harvesting methods in the same year. You will not be able to use capital gains at the 10% and 12% income levels, and then revert to Roth conversions in the 22% and 24% income levels.

Instead, the best way to approach this entire idea is to understand where your marginal dollars fall in any given tax year and then apply these ideas to ensure those marginal dollars capture as much tax arbitrage as possible.

What Factors Should You Consider?

As with everything in financial planning, we cannot make these types of decisions in a vacuum. We must consider all the various puzzle pieces.

So – what other factors would I consider if faced with an income harvesting optimization problem?

Social Security

can be treated as income. For some retirees, 0% of their Social Security is treated as income. For other retirees, 85% of their Social Security benefits are treated as income.

The OBBBA kind of changes this:

There’s a new $6,000 deduction for seniors (age 65+) with income below certain thresholds. The deduction begins to phase out for Single taxpayers and Joint filers with incomes exceeding $75,000 and $150,000, respectively. This deduction is available through 2028.

Social Security is still taxed. But there’s a special deduction for certain seniors to make up for this fact.

The point is: you might not want to realize extra income (either Roth conversions or capital gains) if it increases your Social Security taxability OR if it phases you out of this OBBBA tax deduction.

IRMAA

IRMAA, as we’ve frequently discussed in the past, is essentially an extra Medicare tax on high earners, which is approximately equivalent to 1% of income.

The “gotcha” with IRMAA is that it’s a “cliff.” If you go just one dollar (!) into the next IRMAA bracket, it will cost you $100’s (if not over $1000) in IRMAA surcharges.

To make matters more challenging, IRMAA operates on a two-year delay. The income decisions you make here in 2025 will affect your 2027 IRMAA surcharges – and we don’t know what the 2027 IRMAA brackets look like yet! It doesn’t seem fair!

If you’re going to execute Roth conversions or tax-gain harvesting, you must first understand/estimate how it might affect your IRMAA surcharges.

NIIT

The 3.8% Net Investment Income tax applies to capital gains (as we discussed), but also to interest and dividends. It does not apply to IRA withdrawals, though.

However, due to the “stacking” ideas discussed previously in this article, it’s worth understand how any additional income can potentially push your capital gains up above the NIIT thresholds ($200,000 for Individuals, $250,000 for Joint filers), thus accidentally causing an unintented 3.8% on certain capital gains, dividends, or interest.

ACA Subsidies

If you’re pre-Medicare age, you might be using the ACA exchange for your healthcare in a “benefits hacking” sense.

Both Roth conversions and realizing capital gains will directly impact your adjusted gross income (AGI), which directly affects how much of an ACA premium subsidy you’ll receive.

Yes – the OBBBA also affected these thresholds, so make sure you’re aware of the new mechanics starting in 2026.

The extra subsidies introduced by the ARPA (2021) and extended by the Inflation Reduction Act will not be renewed in the BBB. Instead, the ACA returns to its pre-ARP levels starting with the 2026 plan year.

This means that ACA eligibility drops from 400% of the Federal Poverty Level (FPL) back into the traditional 100-400% range, and cost cap formulas revert to their original design.

If your household falls within 100 – 400% FPL and you enroll during the Open Enrollment Period, you will still qualify for standard (non-enhanced) tax credits in 2026.

But overall credit amounts will be smaller, meaning most enrollees will pay much higher out-of-pocket premiums.

State Taxes

State taxes are a boor, because all 50 states do things a little bit differently.

Suffice to say – know your state’s tax rules.

Do your best to understand how ordinary income (like Roth conversions) and investment income (from tax-gain harvesting) are treated in your state’s tax code.

If you think you might move (e.g. to a state with no income tax, or with no retirement tax), it’s worth adding that fact to today’s equation.

Death: Step-Up in Basis and Future Tax Rates of Heirs

Both Roth conversions and tax-gain harvesting beg an important question:

If you did nothing and eventually died, what would the tax rates on those dollars look like then?

This is such a tricky question because who knows when you’ll die?!

If your doctor says you have 6 months to live, that’s tragic. Though it does make today’s problem easier to solve.

If, instead, you’re a healthy, vibrant, 64-year old woman (or similar), my two cents is that death is too far off and too unknown for you to drastically alter your financial plan today.

Here’s why I say that:

When you die with taxable assets, your heirs inherit those assets at a stepped-up cost-basis, essentially nullifying any unrealized taxable gains. You would never intentionally realize capital gains today if you knew you were going to die tomorrow.

When you die with qualified, tax-deferred assets, your (non-spouse) heirs inherit those assets via an inherited IRA, and they’ll have 10 years (typically) to distribute those assets at their income tax rates. You would never execute a Roth conversion at 24% today if you knew you would die tomorrow and your heirs would pay 10% or 12% on distributions.

The point is that death matters. But only if death is a reasonable and definable timeline in your financial plan.

Summary

Yes, today’s topic isn’t simple. There is nuance to understanding if you should execute Roth conversions or intentionally realize capital gains using the limited “space” inside your annual taxes.

But done correctly, these types of tax arbitrage techniques can save you $1000’s on taxes every year, and lead to substantial long-term compounded benefit.

It’s an essential aspect of any financial plan.

Thank you for reading! Here are three quick notes for you:

First – If you enjoyed this article, join 1000’s of subscribers who read Jesse’s free weekly email, where he send you links to the smartest financial content I find online every week. 100% free, unsubscribe anytime.

Second – Jesse’s podcast “Personal Finance for Long-Term Investors” has grown ~10x over the past couple years, now helping ~10,000 people per month. Tune in and check it out.

Last – Jesse works full-time for a fiduciary wealth management firm in Upstate NY. Jesse and his colleagues help families solve the expensive problems he writes and podcasts about. Schedule a free call with Jesse to see if you’re a good fit for his practice.

We’ll talk to you soon!