What caught my eye this week.

With the price of Bitcoin surpassing $120,000 and US regulators doing some very crypto-friendly regulating, the digital tokens look on the cusp of becoming fully institutional.

For good or ill, I’ll add – and not just because most of you remain sceptical.

My own feelings over the past decade have gone from somewhat cautious to cautiously accepting. Of Bitcoin, I should stress. Not of the thousands of other ephemeral digital tokens that bloom and die like so many bluebottles above a rubbish dump.

Yet even as only a soft believer, it’s hard not to be concerned that once again the UK has failed to keep up with the US. This despite us having had a far more advanced fintech ecosystem a decade ago.

In just this week’s news from across The Pond:

- BlackRock’s Bitcoin ETF became the fastest-ever to hit $80bn in assets

- US crypto firms are looking to secure banking licenses, the Financial Times reports

- Polymarket is the latest in a string of crypto-adjacent outfits who’ve seen legal probes dropped by the Trump administration

- Crypto giant Grayscale has filed to go public…

- …and no wonder, when another, Circle Internet, is now valued at more than $50bn – having multiplied six-fold since its IPO less than two months ago

It looks pretty frothy for sure, but who knows? People said the same thing when Bitcoin first breached $10,000 in 2017 and again when screenshots of apes sold for $3m in 2021.

And yet here we in 2025, with the bubble/revolution going stronger than ever.

Slowly does it on British Bitcoin ETFs

Again for good or ill, here in the UK things are spectacularly less vibrant.

The FCA announced in early June that it proposed to lift the ban on crypto exchange-traded products for retail investors. That would pave the way for holding Bitcoin assets in your ISA or SIPP – instead of having to invest in sub-optimal proxies such as the US Bitcoin hoarding company Strategy, or one of the herd of emerging and even more over-valued UK copycats.

However I’ve yet to see a date for when the FCA will do this. Some have speculated 2026.

Why such a long delay? Bitcoin ETFs have been available in the US for 18 months and they already hold over $100bn in assets. What is the FCA going to learn that the US doesn’t know between now and 2026?

I appreciate crypto might be unpalatable to regulators – and many Monevator readers – but if you’re going to do it, get on with it.

This isn’t the sleepy 1970s anymore.

They boom, we bust

Elsewhere, the once-promising UK crypto platform Ziglu has gone into administration.

Coin Telegraph reports:

Thousands of savers face the grim prospect of losing their investments after administrators uncovered a two million pounds ($2.7 million) shortfall at Ziglu, a British cryptocurrency fintech that collapsed earlier this year.

Ziglu customers aren’t the only ones with sad faces. I was one of thousands of small investors who together invested millions when Ziglu crowdfunded on Seedrs a few years ago.

Like most such failures, it looks a terrible investment in hindsight. But at the time there was lots to be hopeful about.

Ziglu was the brainchild of Mark Hipperson, a co-founder of already-successful startup Starling Bank. Its customer count was quadrupling year-over-year by 2021. Even after crypto retraced thereafter, an acquisition of Ziglu was agreed with the US fintech giant Robin Hood.

Alas the takeover collapsed following the 2022 downturn. And so here we are.

Talking of Robin Hood, that 12-year old company is now valued at $93bn!

Sadly the UK equivalent – Freetrade – was sold to IG Group for £160m in January.

A reach for the stars

Perhaps it’s not surprising that the UK fintech winners – including the self same Starling, incidentally – are mulling US stock market listings. It would be yet another blow for UK markets.

Going by the comments on TA’s Revolut review this week, some readers seem to think the likes of Revolut and Monzo are still fly-by-nights in the Ziglu mould.

This is far from the case.

With 12 million customers, Monzo recently raised funds at a valuation of around $5bn and it’s reportedly on-track for a £6bn IPO. (Disclosure: I’m a Monzo shareholder).

And with more than 50m customers, Revolut recently raised money from Schroders at a $48bn valuation.

Such numbers dwarf the equivalents at most investing-only platforms.

To me, the idea that these UK-founded growth stars aren’t automatically looking at an LSE-listing is yet another inditement of how far Britain has fallen since 2016 .

This increasingly-endemic national lack of dynamism will hurt us all.

I know I’m a stuck record on this and it’s not joyous reading. I’m generally an optimistic person and the first ten years of this blog’s life reflected that. I can only call it as I see it.

I did have high hopes this time last year, but so far there’s been little acknowledgement of why we’re in this state, and only pointless conflicts as we fiddle around the margins.

At least the FTSE 100 is hitting all-time highs. Perhaps that’ll spark something.

Personally I just see an ongoing liquidation sale. The family silver being sold to US private equity at a 30% discount.

Still, up is up. And we can all make decisions to improve our own financial situation, whatever the backdrop. Being naughtily active, I’ve been overweight the UK for a couple of years now, simply on account of the value on offer.

This isn’t contradictory. The grim environment is exactly what creates the downbeat pricing and attracts the takeout offers.

My new side, side-hustle: a London property newsletter

Finally and on a completely different note, a quick plug for a new hobby of mine that will interest most of you even less than Bitcoin.

I’ve started a new London-focussed property newsletter – Propegator – over on SubStack.

Propegator is Weekend Reading but for houses. It’s London-centred because I live here, not because I’m a member of the metropolitan elite. And while I won’t totally ignore the reality of Britain’s broken property market, I will lean into a property pornographer’s take on the loveliest listings.

Which is to say: this will not be home-from-home for the frugalistas among you.

What can I say? In the two decades of pushing my nose up against the glass before I finally bought my own flat, I became a property addict. Call it Stockholm Syndrome.

Also, in another life I’d have been an architect. (How’s that for a post-FIRE aspiration?)

I guess I outed myself with my South Kensington speculations the other week anyway.

Like and subscribe

About a quarter of Monevator readers live in and around the capital. Hence why I’m flagging this property newsletter here. I hope some of you enjoy it and subscribe.

Propegator won’t grow into a Monevator 2.0. It’s more that I read so many stories to compile these links each week that I hope I can almost bolt on another almost effortlessly.

Well, that and a newsletter helps me justify all the time I spend on The Modern House.

Have a great weekend.

From Monevator

Is Revolut good for investing? – Monevator

Discretionary trusts: cautious optimism – Monevator [Mogul members]

From the archive-ator: Keep it simple, stupid – Monevator

News

Inflation jumps to 3.6% on fuel and food price pressures – Sky

Savers to be targeted with offers to buy shares under Reeves’ new plans – BBC

Number of UK job hunters rises at fastest rate since pandemic – Guardian

Homes for sale at seven year high as landlords flood the market – This Is Money

New ‘buy now, pay later’ affordability checks to cover even the smallest loans – Guardian

Renters could end up £340,000 worse off than homeowners over 30 years – This Is Money

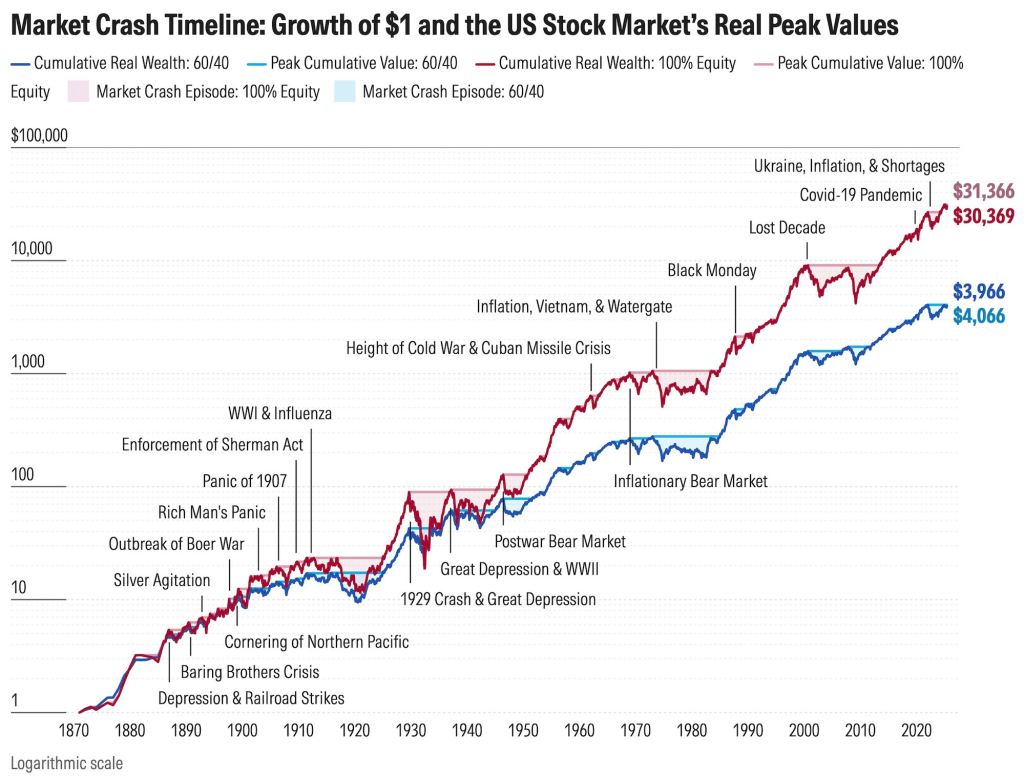

The 60/40 portfolio: a 150-year stress test [US but relevant] – Morningstar

Products and services

Strangely, the best fixed-rate mortgage deals have gotten cheaper… – This Is Money

…even as Best Buy fixed-rate savings deals rates edge up – Which

Six tricks to turbocharge your Boots Advantage card points – This Is Money

Get up to £2,000 when you switch to an Interactive Investor SIPP. Terms and fees apply. – Interactive Investor

How to get £175 by switching bank account to Barclays – Be Clever With Your Cash

Key features of the Renter’s Rights Bill [Advertorial, but worth a read] – Standard

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply. Capital at risk) – InvestEngine

Anger over Santander charging for ‘forever free’ business accounts – Guardian

How to save money at Waitrose – Be Clever With Your Cash

Why aren’t more firms signed up to the Death Notification Service? – Which

Homes for sale for summer entertaining, in pictures – Guardian

Comment and opinion

What Reeves’ Mansion House speech means for savers and homebuyers – Which

How large are global financial assets? [Free to read, infographic] – FT

The death of the Amex lounge – Of Dollars and Data

Let’s be honest, £50,000 is no longer a decent salary… – Standard

…oh heck, nor is £100,000 in London apparently – Standard [Again]

Gen Z trades stocks the same way it gambles – Sherwood

Bring the noise – Behavioural Investment

UK house prices are more affordable than 20 years ago – This Is Money

Staying sober in a world without commercial breaks – Root of All

Is this the worst decade ever for bonds? [US but relevant] – A Wealth of Common Sense

What you see is all there is – Klement on Investing

The hidden cost of index replication – Larry Swedroe

Is it worth determining your personal rate of inflation? – Simple Living in Somerset

Stock and ETF tokenisation mini-special

Top advisor predicts tokenised stocks will replace ETFs by 2030… – Investment News

…or maybe not. Innovations take time to earn staying power – Humble Dollar

Naughty corner: Active antics

Value: that was then, this is now [PDF] – GMO

What London’s listed PE stocks tell us about private equity – Verdad

Bad bet: on picking active funds – Morningstar

Volatility is a reliable and convenient proxy for downside risk – Alpha Architect

Good holding companies are more effective allocators than VCs – Investing 101

Omaze house lottery mini-special

Inside the wild phenomenon of house lotteries – Independent

Omaze bids to end planning saga at £6m home – BBC

Kindle book bargains

The Tipping Point by Malcolm Gladwell – £0.99 on Kindle

Chip War: The Fight for the World’s Most Critical Technology by Chris Miller – £0.99 on Kindle

The Everything Store: Jeff Bezos and the Age of Amazon by Brad Stone – £0.99 on Kindle

Essentialism: The Disciplined Pursuit of Less by Greg McKeown – £1.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator store

UK environmental factors mini-special

Extreme weather is the UK’s new normal, says Met Office – BBC

In some UK woodlands, every young tree has died – Guardian

UK sea levels rising faster than global average, study finds [Paywall] – FT

Sheep are destroying precious British habitats, and taxpayers are footing the bill – Guardian

Cranes are back in Scotland after 500 years – STV News

Robot overlord roundup

AI is coming for middle management jobs, too – Independent

Anthropic launches Claude version for financial services – Venture Beat

Chain-of-thought is not explainability [Research, PDF] – via Alphaxiv

Worse than MechaHitler – Don’t Worry About The Vase

Some academics have been hiding AI prompts in their papers – Smithsonian

The labour market impact of generative artificial intelligence [Research] – SSRN

Not at the dinner table

A trip to the G7 horror show with Emmanuel Macro – Guardian

Jerome Powell and the authoritarian sirens of Odysseus – G.O.F.P.

The treason of the tech oligarchs – Liberal Currents

How magical thinking came for UK’s net zero critics [Paywall] – FT

Tinpot dictator chic: the Oval Office interior is going heavy on gold – Sherwood

X is now Elon’s personal propaganda platform – Tech Dirt

Trump’s Brazil sanctions are nakedly political and won’t fly anyway – Drezner’s World

Off our beat

The menagerie lurking in rural America – Slate

How well are developing countries, well, developing? – Noahpinion

Ten things learned from a decade of doing one thing – Darius Foroux

Homo crustaceous – Aeon

The other millennium dome: the comeback of Wales’ national garden – Guardian

Darth Vader’s lightsaber to go up for auction for an estimated £2.2m – Independent

And finally…

“Even when the playing field is level, the institutions are weak opponents and, as it happens, there are several areas where the small private investor actually has an advantage.”

– Jim Slater, Beyond the Zulu Principle

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.